$500m Q1 net loss amid massive dealer profit years…

$327 stock price down to $65…

Carvana never turned a profit…

Carvana has no proprietary tech…

Carvana created no unique value proposition…

Lack of customer service and post-sale follow up…

Limited human element to experience…

Customer complaints expanding…

Just relentless anti-dealer advertising…

It actually speaks to the power of Branding: creating awareness and preference through emotion, recall, relatability, and value.

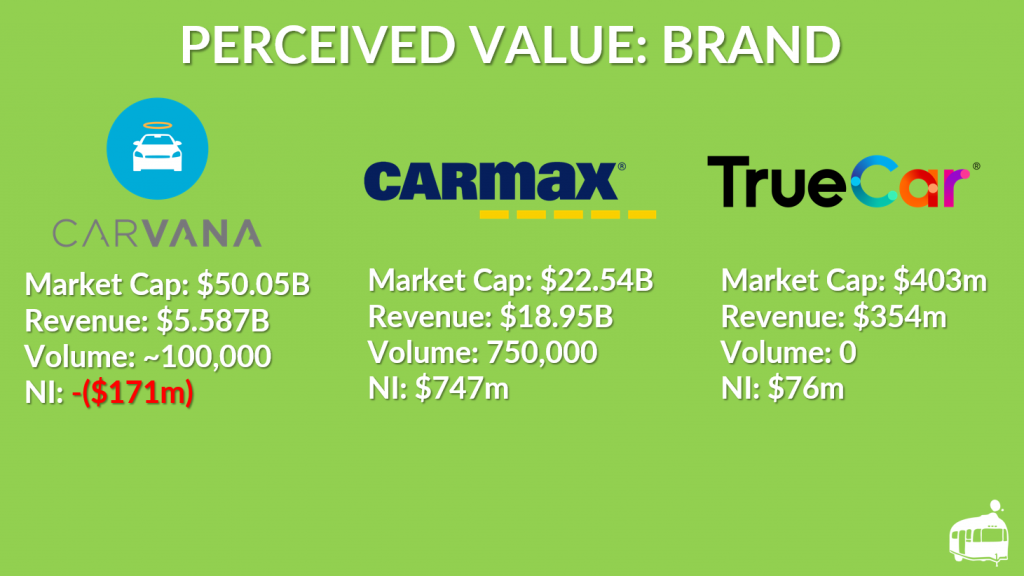

But we need to back the train up a bit. For clarity, Carvana had a market cap of $50 billion last year selling less than 100,000 units. Carmax, for example, had a market cap of $22 billion selling 750,000 units. What was the difference? Carvana was seen as a “Disruptor” by the street and the valley.

So what does Carvana do that a dealer cannot? Actually, nothing. What do have? A great BRAND and DEEP POCKETS. One that tapped into the collective mindset of many Americans who may have been taken advantage of at a (perhaps nefarious) dealership.

Creating a smooth UX on their website, clean and simple navigation, and powerful creative content to drive users is what made Carvana a $50bn market cap.

Unfortunately, they never followed through with the human aspect after “disrupting” the auto space. Retail automotive requires human touch, nuance, follow up, access, service, experience…and so much more.

Remember that at the end of the day, your customers are humans…not robots.

Perhaps we are recognizing a $350 P/E ratio from “disruptive” tech isn’t really what people wanted…maybe people still like to buy from people, especially for the second largest purchase in their lives…

Perhaps just because something is “disruptive” and the tech bros and street like it, doesn’t mean it’s inherently “good”….